Forex Candlestick Patterns Cheat Sheet

Candlestick patterns are an effective way to help forex traders read currency charts. Benzinga compiled this forex candlestick patterns cheat sheet to help you learn what candlestick patterns you can use in a bearish and bullish currency market.

What is a Candlestick?

Candlestick charts originated in Japan as an informative and compact way to track market prices visually. They later became popular worldwide since they show reliable candle pattern types that traders can incorporate into their trading strategies.

A candlestick chart shows how the value of a stock, currency pair or security evolves over time. Such a chart consists of a series of individual candlesticks that represent the high, low, opening and closing values observed over a certain period of time. These charts also display a variety of common candlestick patterns that forex traders can use to their advantage.

Technical traders might use candlestick charts computed for one or multiple timeframes, such as 15-minute charts, 1-hour charts or daily charts, to name a few. Check out the detailed candlestick patterns cheat sheet below for more information on forex candlestick patterns and how to use them.

Reading Currency Charts with Candlestick Patterns

A candlestick consists of a body and two wicks. The upper and lower wicks on each end of a candlestick’s body respectively represent the currency pair’s highest and lowest exchange rates observed during the candlestick’s time period.

The body of a candlestick is bounded by the opening and closing exchange rates for the relevant time frame. The body is assigned one of two colors, depending on whether the market closed that time period higher or lower than it opened.

If the exchange rate at the close of a given time frame is higher than at the open, then the candle’s body for that time frame will typically be green or white by default, although a user can usually adjust the colors in their technical analysis software. Conversely, if the exchange rate closes below its open for a time frame, the candle will typically be red or black by default.

Candlestick charts provide a visual tool to help traders get a feel for the forex market and identify various candle shapes or multi-candle patterns that have predictive value. You can use candlestick charts to identify a trending market and to trade based on the appearance of reliable candlestick patterns.

A forex cheat sheet containing the most useful bearish and bullish candlestick patterns for currency traders appears in the sections below. You can use this cheat sheet as a reference when looking to incorporate candlestick charts into your trading plan.

6 Bearish Forex Candlestick Patterns

While various chart types can be used by technical forex traders, candlestick charts are among the most popular since a variety of bullish and bearish candlestick patterns can show up on these charts that can suggest profitable trades.

Shooting Star

A shooting star is a bearish reversal candlestick pattern that indicates a decline is likely following an upward trend. As the schematic image above shows, the exchange rate initially rises as buyers enter the market. However, the rate then falls back toward its open price as its upward momentum fails.

A shooting star should have an upper wick at least twice the size of its body with only a small lower wick. This candlestick pattern suggests that a bullish run has reached its high, so a reversal could be in process. The bearish signal may fail, however, if the exchange rate subsequently continues to make gains.

Evening Star

An evening star is a relatively rare but reliable candlestick pattern that appears during uptrends and signals a bearish reversal. The relatively complex pattern consists of three candles.

In the first candle, a currency pair's exchange rate rises significantly. The opening of the subsequent small bullish or bearish candle then gaps up. The exchange rate then gaps down to form a bigger bearish candle. The final candle should cover a minimum of half the first candle’s body size.

These signs confirm that an evening star pattern has appeared on the candlestick chart and that a potentially stronger trend reversal to the downside is brewing.

Hanging Man

A hanging man candle is a bearish reversal chart pattern that displays a long lower wick and a small body above it. The hanging man pattern appears during upward trends as they are losing steam and suggests that a downside correction may be imminent.

The appearance of this candle indicates that an increasing number of bearish forex traders are entering the market and attempting to push the exchange rate lower. Although bullish traders force a close higher during this candle’s duration, a bearish reversal may subsequently take place.

Bearish Engulfing

A bearish engulfing pattern is a chart pattern that shows up during bullish trends and signals that a trend reversal is on the horizon. In a bearish engulfing pattern, the exchange rate closes higher in the first candle, but it then falls in the second candle to a degree that encompasses, or engulfs, the full extent of the first candle. The bearish engulfing pattern can be a helpful reversal indicator that suggests an aggressive move to the downside is on the horizon, although it is less reliable in choppy markets.

A bearish engulfing candlestick pattern. Source: Benzinga.com.

Dark Cloud

A dark cloud is a bearish reversal chart pattern consisting of two candlesticks. It forms when the market initially gaps up to open a candle above the previous bullish candle’s close, but the market then ultimately closes below the midpoint or 50% mark of the first candle to form a bearish second candle.

A dark cloud pattern shows that a substantial shift in market momentum from the upside to the downside has taken place. Both the initial bullish and the final bearish candles can be quite large, suggesting a significant number of market participants were involved.

More conservative traders might look for confirmation by waiting for another bearish candle to appear after the dark cloud pattern to signal a selling opportunity.

Three Black Crows

The bearish three black crows chart pattern is a reversal pattern that typically shows up at the end of an uptrend. It consists of three candlesticks that all close lower than the previous candle. This candlestick chart pattern implies strong downside momentum and can be used alongside other technical indicators.

6 Bullish Forex Candlestick Patterns

While various bearish candlestick patterns are used, traders also rely on many bullish patterns as well.

Bullish Engulfing

The opposite of the bearish engulfing pattern, the bullish engulfing pattern is a two-candle pattern that starts out with a bearish red candle and completes with a bullish green candle that engulfs the previous red candle. This bullish pattern typically shows up after a market decline to suggest a potentially aggressive upside move may be on the horizon.

A bullish engulfing candlestick pattern. Source: Benzinga.com.

Hammer

A hammer is a bullish single candle signal of the conclusion of a downward trend and the possibility of a turnaround to the upside. A hammer pattern occurs when a currency pair drops noticeably lower but then spikes higher within the time frame of a single candle. As a result, the candle appears like a hammer since the lower wick is much larger than the actual body.

For a hammer to emerge, sellers cause the exchange rate to decline. However, buyers then absorb the selling pressure and push the exchange rate back up to close just above its opening price. The hammer formation thus indicates potential upside gains for bullish traders.

Inverted Hammer

An inverted hammer is a type of bullish single candle that occurs on a candlestick chart after buyers begin putting upward pressure on a currency pair. It tends to have a large upper wick, a short lower wick and a small body. The name comes from the shape of the candle since it looks like an upside-down hammer.

An inverted hammer candle is most commonly seen at the bottom of a downtrend where it signals the start of an upside reversal. Bullish traders begin to gain some confidence and attempt to push the exchange rate higher. Although this attempt may be unsuccessful initially, the inverted hammer candle signals that bullish pressure is emerging.

Morning Star

The morning star pattern consists of three candles that signal the formation of a bullish trend after a downtrend. After the first candle falls, the market gaps lower to open the second candle below the first, but the second candle has a much smaller red or green body than the first.

The market then gaps up to open the final bullish candle that exceeds the midpoint of the first candle. The morning star pattern captures a moment of market indecision. Traders can watch for this pattern to seek confirmation that an upside reversal is developing after a bear phase.

Piercing Line

A piercing line pattern is a two-candle reversal pattern that marks the transition from a downtrend to an uptrend. The first candle of this pattern opens near the high and closes near the low, so it has two small wicks. The second candle then gaps down but closes near its high and above the 50% midpoint of the first candle. This pattern indicates that a near-term upside reversal could take place.

Three White Soldiers

The three white soldiers pattern is the reverse of the three black crows pattern. It involves three green candles that each close above the previous high and tend to have short wicks. This bullish reversal pattern indicates strong upside momentum emerging after a downtrend.

Additional Candlestick Patterns Traders Should Know

Over 50 established bullish and bearish candlestick patterns exist to help traders forecast near-term moves in the financial markets. You can research the full range of these useful patterns online and in books dedicated to the subject. A few additional candlestick patterns that traders should be aware of are mentioned below.

Doji

A doji candlestick occurs when the opening and closing levels of a candle are perfectly equal. Doji candles typically show large wicks and bodies that consist of a horizontal line. The directional implication of a doji depends on its form, as the image below shows.

Four types of doji candles and their directional implications. Source: CoinVestasi.com.

Spinning Top

A spinning top candlestick features a short body vertically positioned in the middle of extended upper and lower wicks. When this pattern forms, it represents a period of indecisiveness in the market. The opening and closing levels are similar in spinning top candles, but buyers and sellers attempted to push the market in both directions during its duration. A bullish spinning top has its close above the open, while a bearish spinning top has its open above its close.

Falling Three Methods

The falling three methods pattern is a bearish pattern that appears in a downtrend. The first red candle makes a significant move lower and has a large body, but green candles two through four make small gains higher but do not exceed the high or low of the first candlestick. The fifth and final red candle then falls significantly from its open below the previous candlestick’s close to a close below the close of the first candlestick. The falling three methods pattern suggests a bearish trend is likely to remain in effect despite a slight upside correction.

The falling and rising three methods candlestick patterns. Source: Vecteeezy.com.

Rising Three Methods

The rising three methods pattern appears during an uptrend and is the opposite of the falling three methods pattern. In this bullish pattern, the first and last candles are bullish, with the small three candles in the middle correcting modestly lower. This pattern indicates that sellers could not push the market significantly lower, so the uptrend is likely to continue.

Trade Your Strategy

Many very useful candlestick patterns exist to choose from, although how to incorporate them into a forex trading strategy will depend on an individual trader’s preferences. While these patterns can help improve your profitability and edge as a trader when used alone, they usually provide the best trading opportunity when used in combination with other technical indicators that can confirm the validity of their signals.

Learn Candlestick Patterns with These Forex Brokers

Learning about the more reliable candlestick patterns and how to trade them is a great way to boost your success as a forex trader. Getting started putting these patterns into practice generally requires the services of an online forex broker, so look through and compare some of the best forex brokers listed in the table below to help narrow down your options and implement this cheat sheet.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

86% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

eToro USA LLC; Investments are subject to market risk, including the possible loss of principal. CFD trading is not available to U.S. users and 77% of retail CFD accounts lose money.

Best For

Non US Forex Trading

Best For

Investors interested in 0% commission or eco conscious trading

CedarFX is not regulated by any major financial agency. The brokerage is owned by Cedar LLC and based in St. Vincent and the Grenadines.

Frequently Asked Questions

Q

How many types of candlestick patterns are there?A

Candlestick patterns are generally either bullish or bearish, but there are over 50 well-established candlestick patterns for traders to watch for.

Q

Which candlestick is best for scalping?A

It can be challenging to narrow down the best candlestick pattern for scalping. For some, it is the shooting star and its inverse pattern the hammer, but opinions differ.

Q

What is a strong candlestick?A

Most of the patterns discussed in this article are strong because they show clear and reliable bullish or bearish signals that traders can include in a trading plan.

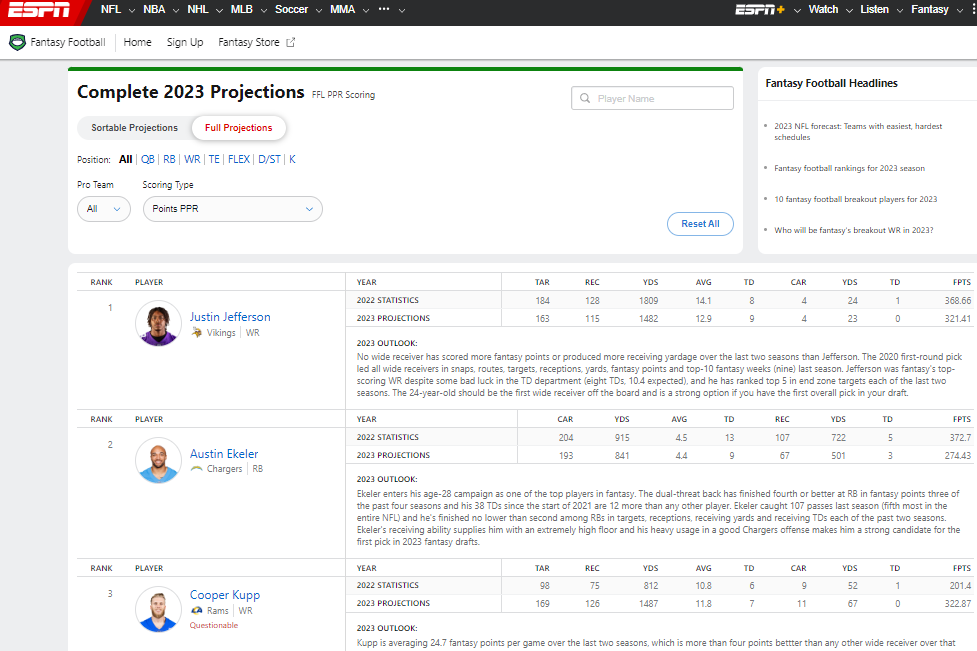

Fantasy Football cheat sheets: PPR, non-PPR, depth charts

If you're seeking a one-stop shop for updated 2023 fantasy football rankings, depth charts and cheat sheets throughout the summer, you've come to the right place. Below, you will find them for PPR (point per reception) and non-PPR formats, as well as dynasty leagues.

Pigskin Win Totals

Take your shot at picking win totals for all 32 teams for a chance to win up to $10,000!Make Your Picks

PPR positional cheat sheetOne sheet with players broken down by position, including overall rank, salary-cap value and bye weeks for leagues that award one point for each catch. We recommend this sheet for those using half-PPR, as the rankings are extremely similar. Download »

PPR top-300 cheat sheetThis sheet features 300 players in order of overall draft value, with positional rank, salary-cap value and bye-week information for leagues that reward each catch with a point. We recommend this sheet for those using half-PPR, as the rankings are extremely similar. Download »

Beginner's fantasy football PPR cheat sheetThe beginner's cheat sheet is streamlined to the 160 players you need to know for your 10-team PPR draft, organized by round and a write-in area to keep track of your team. Perfect for the first-time drafters and minimalists alike. Download >>

PPR top-300 superflex cheat sheetThis sheet features our rankings when drafting for a league featuring the offensive player (OP) slot, also known as superflex and available as a custom option in League Manager. The OP position can be filled by any QB-, RB-, WR- or TE-eligible player, which greatly enhances the value of quarterbacks in the rankings. Download »

It's never too early to start your fantasy football season

The offseason is heating up and it's the perfect time to kick off your fantasy season. Create a league and customize league size, scoring and rules to play in the league you want to play in.

Create a league today!

Non-PPR positional cheat sheetFor leagues using the scoring format that doesn't award an extra point for each reception. One sheet with players broken down by position, including overall rank, salary-cap value and bye weeks. Download »

Non-PPR top-300 cheat sheetThis sheet features 300 players in order of overall draft value, with positional rank, salary-cap value and bye-week information. Download »

Mike Clay's team-by-team projection guideIf you want the full breakdown for all 32 teams, you've come to the right place. Download »

Go deeper on every player

Mike Clay's projections and outlooks for hundreds of players for the 2023 fantasy football season.

2023 projections & outlooks

NFL team depth chart cheat sheetFantasy depth charts for each NFL team: top two quarterbacks, three running backs, four wide receivers, two tight ends and a kicker. Prioritized by fantasy value in PPR leagues rather than role-defined on a traditional NFL depth chart, this includes players' overall ranks. Download »

Dynasty cheat sheetFeatures the top 240 players and 60 best rookies to make all of your keeper and dynasty league decisions. Includes the players' draft years/rounds and ages at the start of the 2022 season. Download »

* All cheat sheets are in PDF format. Your device must be equipped with a PDF reader for you to access and print the cheat sheet.