SnowFlake ARA-C01 : SnowPro Advanced Architect Certification Exam DumpsExam Dumps Organized by Shahid nazir |

Latest 2023 Updated SnowFlake SnowPro Advanced Architect Certification Syllabus

ARA-C01 Exam Dumps / Braindumps contains Actual Exam Questions

Practice Tests and Free VCE Software - Questions Updated on Daily Basis

Big Discount / Cheapest price & 100% Pass Guarantee

ARA-C01 Test Center Questions : Download 100% Free ARA-C01 exam Dumps (PDF and VCE)

Exam Number : ARA-C01

Exam Name : SnowPro Advanced Architect Certification

Vendor Name : SnowFlake

Update : Click Here to Check Latest Update

Question Bank : Check Questions

Real test ARA-C01 Question Bank questions accessible for genuine test

We make a great effort to provide you with actual SnowPro Advanced Architect Certification exam questions and answers, along with clarifications. Each ARA-C01 question and answer on killexams.com has been established by certified SnowFlake professionals. They are highly qualified and certified people who have several years of professional experience with SnowFlake exams. They check the ARA-C01 Questions and Answers question according to the actual ARA-C01 test.

Our PDF dumps have helped many competitors breeze through the ARA-C01 test with ease. It is extremely rare for our users to study our ARA-C01 materials and receive poor scores or fail the actual test. In fact, most competitors report a significant improvement in their knowledge and pass the ARA-C01 test on their first attempt. Our ARA-C01 materials not only help you pass the test but also improve your understanding of the test objectives and topics, allowing you to excel in your role as an expert in your field. This is why our clients trust us and recommend our ARA-C01 materials to others.

To successfully pass the SnowFlake ARA-C01 test, you need to have a clear understanding of the course outline, exam syllabus, and objectives. Simply reading the ARA-C01 coursebook is not enough. You need to familiarize yourself with the unique questions asked in the actual ARA-C01 tests. For this, you should visit killexams.com and download our Free ARA-C01 sample test questions. Once you are confident in your ability to recall these ARA-C01 questions, you can enroll to download the complete PDF Dumps of ARA-C01 PDF Braindumps. This will be your first major step towards success. After downloading and installing the VCE test simulator on your computer, study and memorize our ARA-C01 PDF Braindumps and take regular practice tests with the VCE test simulator. When you feel that you are ready for the actual ARA-C01 test, visit the testing center and register for the real exam.

ARA-C01 Exam Format | ARA-C01 Course Contents | ARA-C01 Course Outline | ARA-C01 Exam Syllabus | ARA-C01 Exam Objectives

Exam Specification:

- Exam Name: SnowPro Advanced Architect Certification (ARA-C01)

- Exam Code: ARA-C01

- Exam Duration: 180 minutes

- Exam Format: Multiple-choice and multiple-select questions

Course Outline:

1. Snowflake Architecture Overview

- Understanding the Snowflake architecture and components

- Exploring Snowflake's compute, storage, and services layers

- Understanding Snowflake's data sharing and security features

2. Advanced Data Modeling and Schema Design

- Designing efficient and scalable data models in Snowflake

- Utilizing advanced schema design techniques for performance optimization

- Implementing best practices for managing complex data structures

3. Advanced Query Optimization

- Optimizing SQL queries for performance and cost efficiency

- Utilizing Snowflake's query and execution features

- Implementing advanced query optimization techniques and indexing strategies

4. Advanced Security and Data Protection

- Configuring advanced security features in Snowflake

- Implementing data encryption, access controls, and authentication mechanisms

- Ensuring data privacy and compliance with industry regulations

5. Advanced Data Integration and ETL/ELT

- Integrating data from various sources into Snowflake

- Designing and implementing complex ETL/ELT processes

- Utilizing Snowflake's data loading and transformation capabilities

6. Advanced Snowflake Architecture and Scaling

- Scaling Snowflake for high-performance and large-scale data processing

- Understanding Snowflake's multi-cluster, multi-warehouse, and multi-region architectures

- Implementing advanced data partitioning and clustering techniques

Exam Objectives:

1. Demonstrate an in-depth understanding of the Snowflake architecture and its components.

2. Design and implement advanced data models and schema designs in Snowflake.

3. Optimize SQL queries for performance and cost efficiency in Snowflake.

4. Configure advanced security features and ensure data protection in Snowflake.

5. Integrate data from various sources and design complex ETL/ELT processes in Snowflake.

6. Understand advanced Snowflake architecture concepts and scaling strategies.

Exam Syllabus:

The exam syllabus covers the following topics (but is not limited to):

- Snowflake Architecture Overview

- Advanced Data Modeling and Schema Design

- Advanced Query Optimization

- Advanced Security and Data Protection

- Advanced Data Integration and ETL/ELT

- Advanced Snowflake Architecture and Scaling

Killexams Review | Reputation | Testimonials | Feedback

Do you want dumps latest syllabus ARA-C01 exam to clean the exam?

Killexams.com is an outstanding IT exam practice platform. I passed the ARA-C01 exam without any issues. Their actual questions are based on the way ARA-C01 does it, making it easy to recall the answers during the exam. Though not all questions are the same, most are similar, making it easy to sort them out. Their materials are useful and cool for IT specialists like me.

ARA-C01 real questions are great to read and pass exam.

I took the ARA-C01 coaching from killexams.com, which was an excellent platform for training. I enjoyed the way the topics were presented in an interesting and easy-to-understand manner. With the help of killexams.com, I was able to understand the material and pass the exam with great scores.

Get these ARA-C01 Questions and Answers, put together and chillout!

Before joining killexams.com, I attempted the ARA-C01 exercise questions more than once but was unsuccessful in my studies. I did not realize where I lacked in getting fulfillment until I became a member of killexams.com, which provided the missing piece of ARA-C01 practice books. Preparing for ARA-C01 with ARA-C01 example questions is highly convincing, and the ARA-C01 practice books designed by killexams.com are splendid.

I need dumps of ARA-C01 exam.

Like many others, I passed the ARA-C01 exam recently, and the majority of the exam questions came exactly from this guide. The answers are correct, so if you are preparing for your ARA-C01 exam, you can fully rely on this website.

What a top class material updated ARA-C01 questions that works in actual test.

I would like to express my gratitude to killexams.com for providing the best braindumps for the ARA-C01 exam. The questions were real and accurate, and I found this exam preparation guide to be beyond my expectations. I have already recommended this site to my colleagues who passed the ARA-C01 exam, and I highly recommend it to anyone looking for dependable exam dumps.

SnowFlake Architect Real Exam Questions

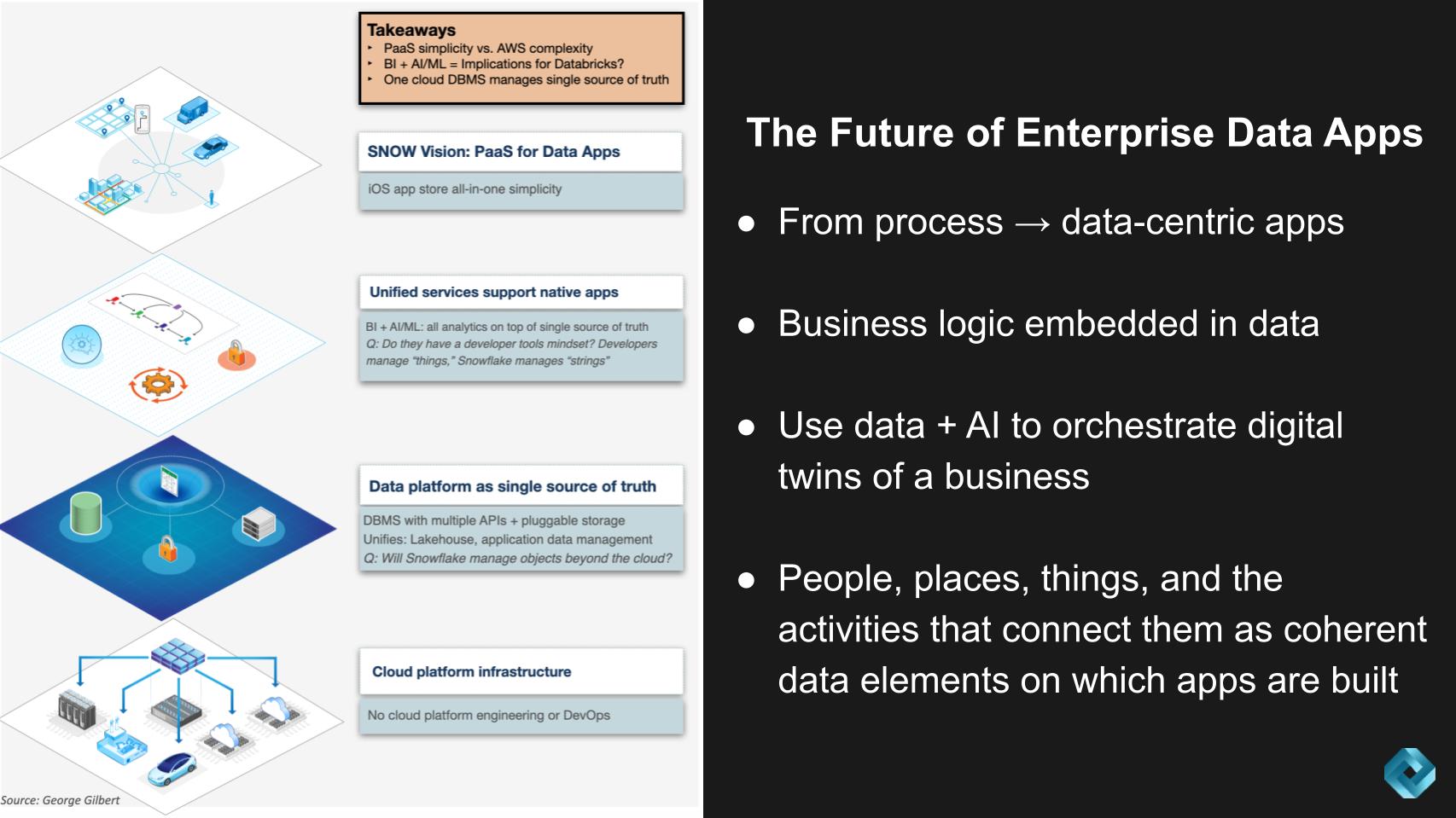

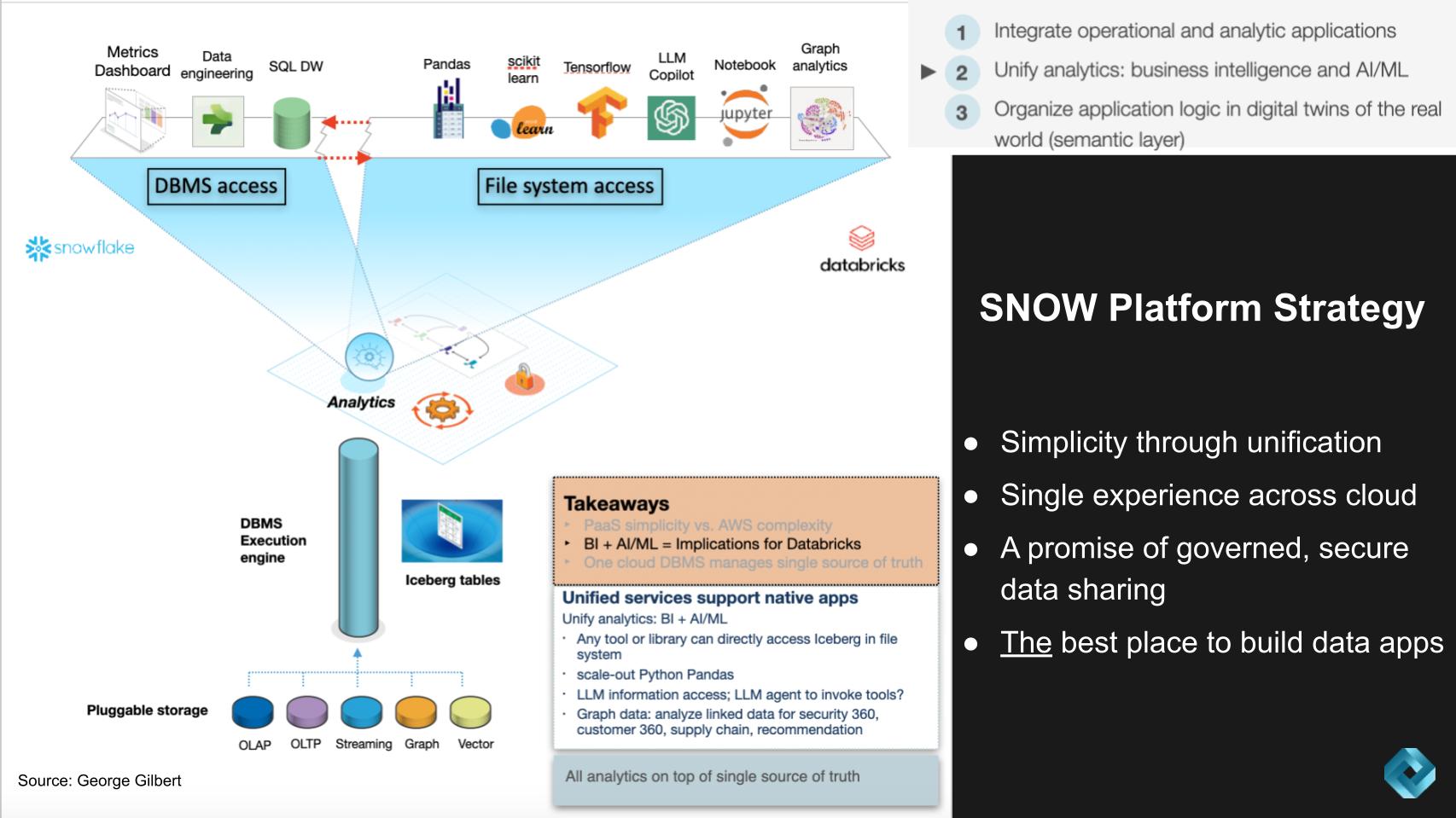

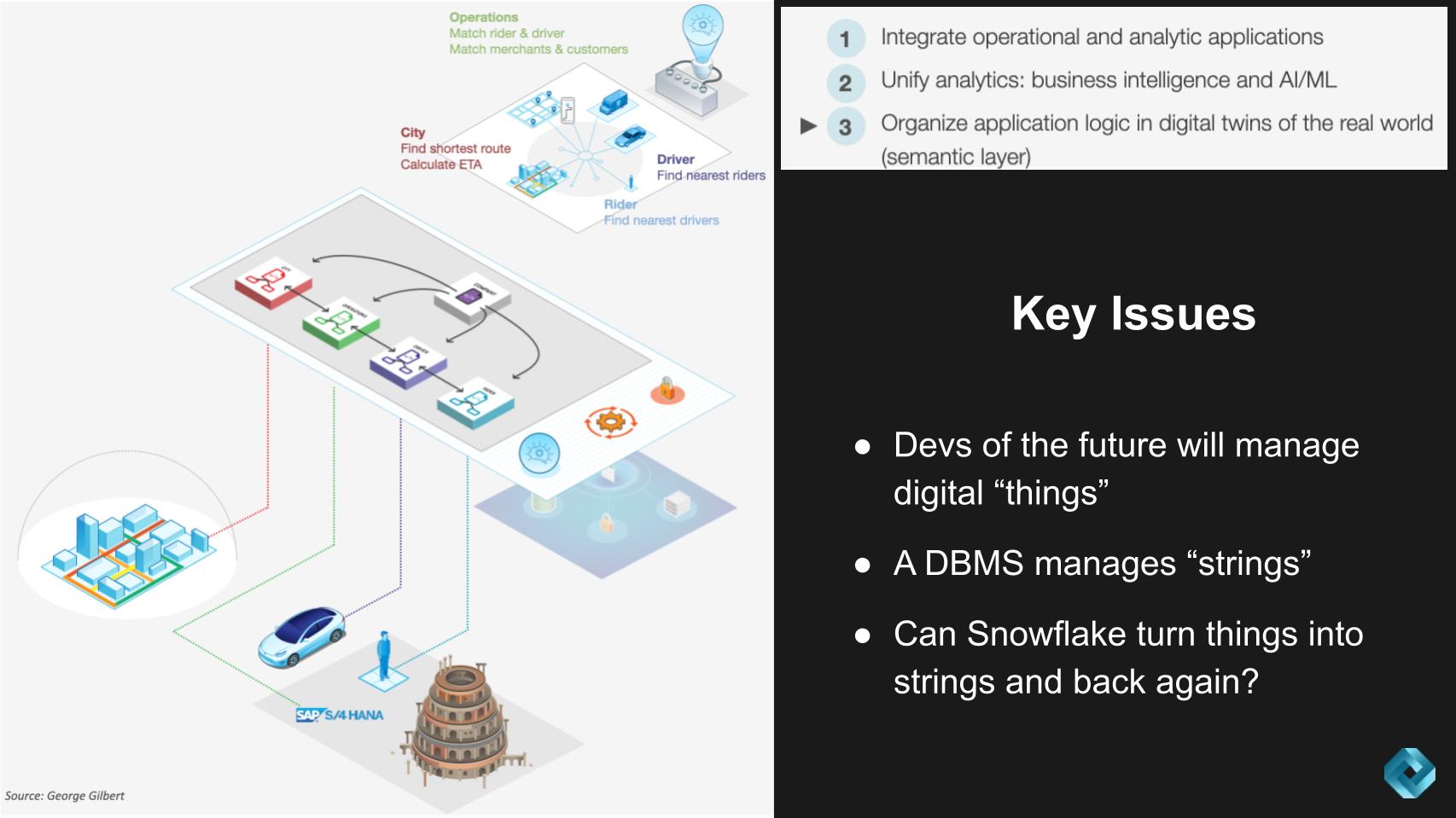

Snowflake Summit will reveal the future of data apps. Here’s our take.Our research and analysis point to a new modern data stack that is emerging where apps will be built from a coherent set of data elements that can be composed at scale. Demand for these apps will come from organizations that wish to create a digital twin of their business to represent people, places, things and the activities that connect them, to drive new levels of productivity and monetization. Further, we expect Snowflake Inc., at its upcoming conference, will expose its vision to be the best platform on which to develop this new breed of data apps. In our view, Snowflake is significantly ahead of the pack but faces key decision points along the way to its future to protect this lead. In this Breaking Analysis and ahead of Snowflake Summit later this month, we lay out a likely path for Snowflake to execute on this vision, and we address the milestones and challenges of getting there. As always, we’ll look at what the Enterprise Technology Research data tells us about the current state of the market. To do all this we welcome back George Gilbert, a contributor the theCUBE, SiliconANGLE Media’s video studio. A picture of the new modern data stackThe graphic below describes how we see this new data stack evolving. We see the world of apps moving from one that is process-centric to one that is data-centric, where business logic is embedded into data versus today’s stovepiped model where data is locked inside application silos.

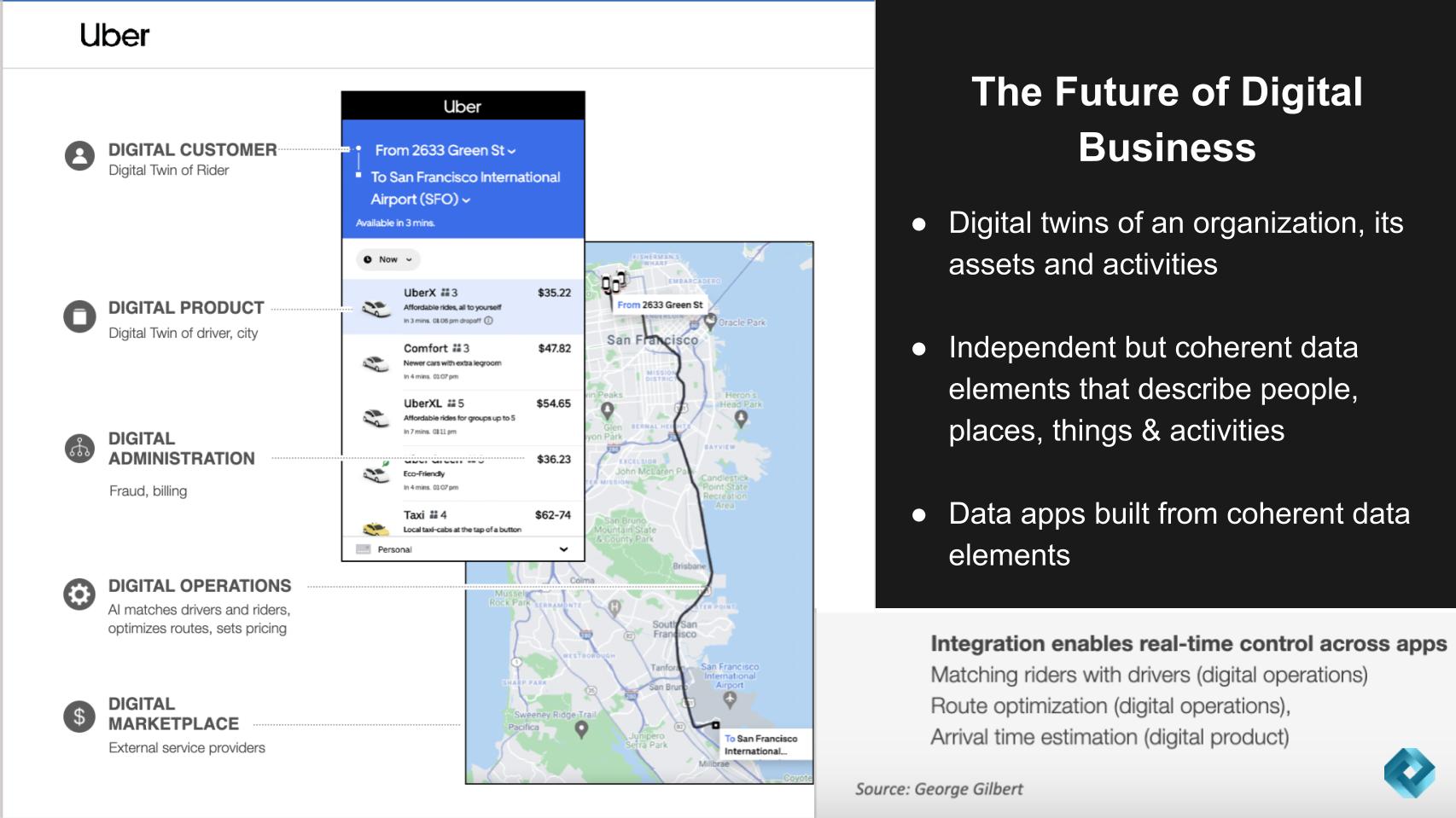

There are four layers to the emerging data stack supporting this premise. Starting at the bottom is the infrastructure layer, which we believe increasingly is being abstracted to hide underlying cloud and cross-cloud complexity — what we call supercloud. Moving up the stack is the data layer that comprises multilingual databases, multiple application programming interfaces and pluggable storage. Continuing up the stack is a unified services layer that brings together business intelligence and artificial intelligence/machine learning into a single platform. Finally there’s the platform-as-a-service for data apps at the top of the picture, which defines the overall user experience as one that is consistent and intuitive. Here’s a summary of Gilbert’s key points regarding this emerging stack: The picture above underscores a significant shift in application development paradigms. Specifically, we’re transitioning away from an era dominated by standalone Web 2.0 apps, featuring microservices and isolated databases, toward a more integrated and unified development environment. This new approach focuses on managing “people, places and things” – and describes a movement from data strings to tangible things. Key takeaways include: This suggests a compelling trend for stakeholders to watch. The advent of a more unified and integrated development environment is a game-changing evolution. It encourages stakeholders to consider solutions like Snowflake, which simplifies and enhances the development process, thereby promoting efficiency, reducing complexity and driving new levels of monetization. The key question is: Can Snowflake execute on this vision and can they move faster than competitors including the hyperscalers and Databricks Inc., which we’ll discuss later in this research. Listen to George Gilbert describe the new modern data stack. North star: Uber-like applications for all businessesLet’s revisit the Uber analogy that we’ve shared before.

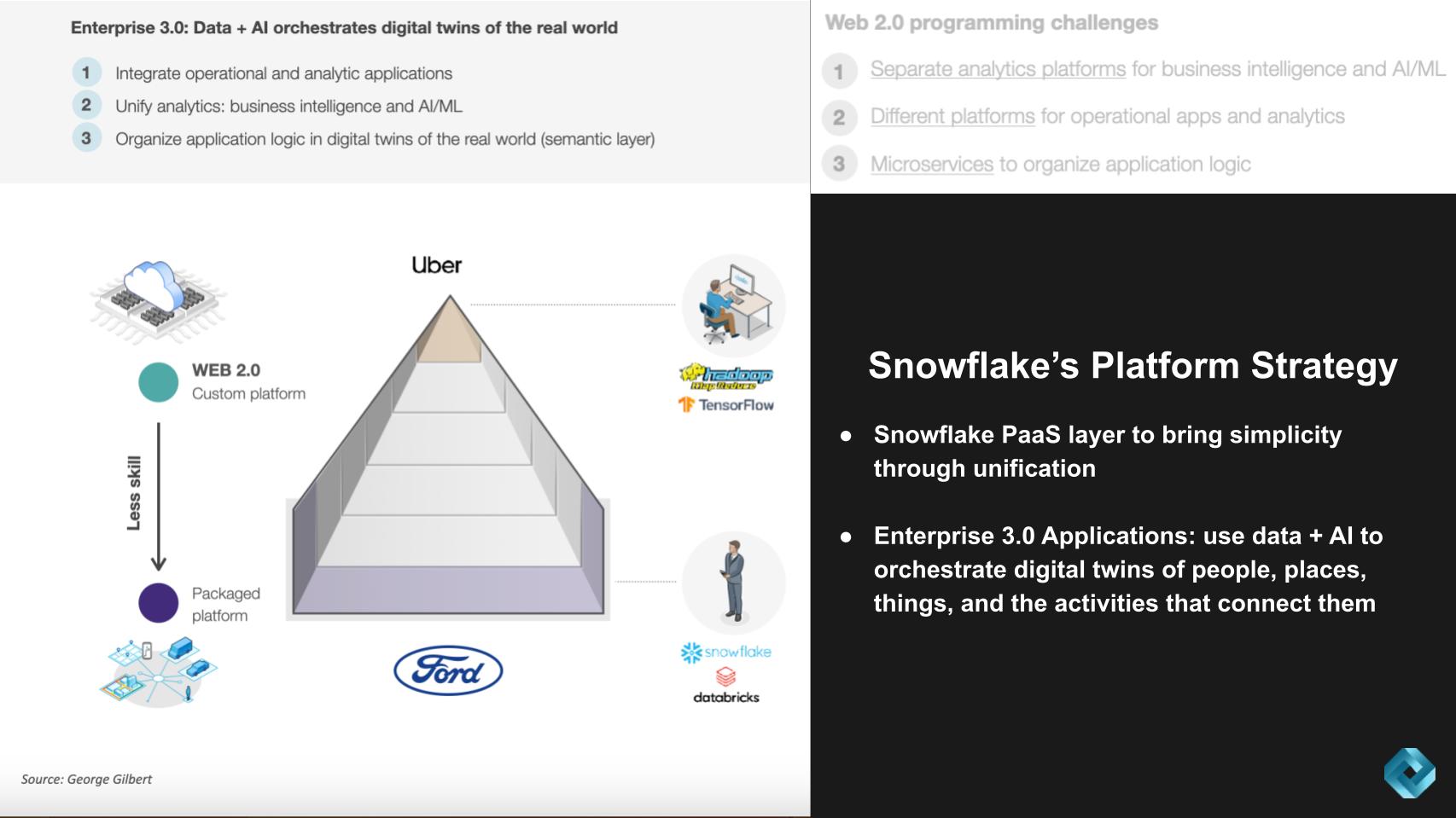

The idea described above is that the future of a digital business will manifest to a digital twin of an organization. The example we use frequently is Uber for business where, in the case of Uber Technologies Inc., drivers, riders, destinations, estimated times of arrival, and the transactions that result from real-time activities have been built by Uber into a set of applications where all these data elements are coherent and can be joined together to create value, in real time. Here’s a summary of Gilbert’s take on why this is such a powerful metaphor: We believe the paradigm shift in application development will increasingly focus on applications being organized around real-world entities such as people, places, things and activities. This evolution reduces the gap between a developer’s conceptual thinking and the real-world business entities that need management. Key points include: We believe the vision presented by Gilbert has profound implications for those involved in application development. It’s important for stakeholders to realize that the new era of applications calls for a different kind of thinking – one that aligns with orchestrating real-world activities through a unified, coherent development environment. This has the potential to increase efficiency dramatically and enable more complex, autonomous operations. Watch and listen to George Gilbert describe the future of application development and the key enablers. Simplifying application development for mainstream organizationsA major barrier today is that only companies such as Uber, Google LLC, Amazon.com Inc. and Meta Platforms Inc. can build these powerful data apps. Starting 10-plys years ago, the technical teams at these companies have had to wrestle with MapReduce code and dig into TensorFlow libraries in order to build sophisticated models. Mainstream companies without thousands of world class developers haven’t just been locked out of the data apps game, they’ve been unable to remake their businesses as platforms. To emphasize our premise, we believe the industry generally and Snowflake specifically are moving to a world beyond today’s Web 2.0 programming paradigm where analytics and operational platforms are separate and the application logic is organized through microservices. We see a world where these types of systems are integrated and BI is unified with AI/ML. And a semantic layer organizes application logic to enable all the data elements to be coherent. In our view, a main thrust of Snowflake’s application platform strategy will be to simplify the experience dramatically for developers while maintaining the promise of Snowflake’s data sharing and governance model.

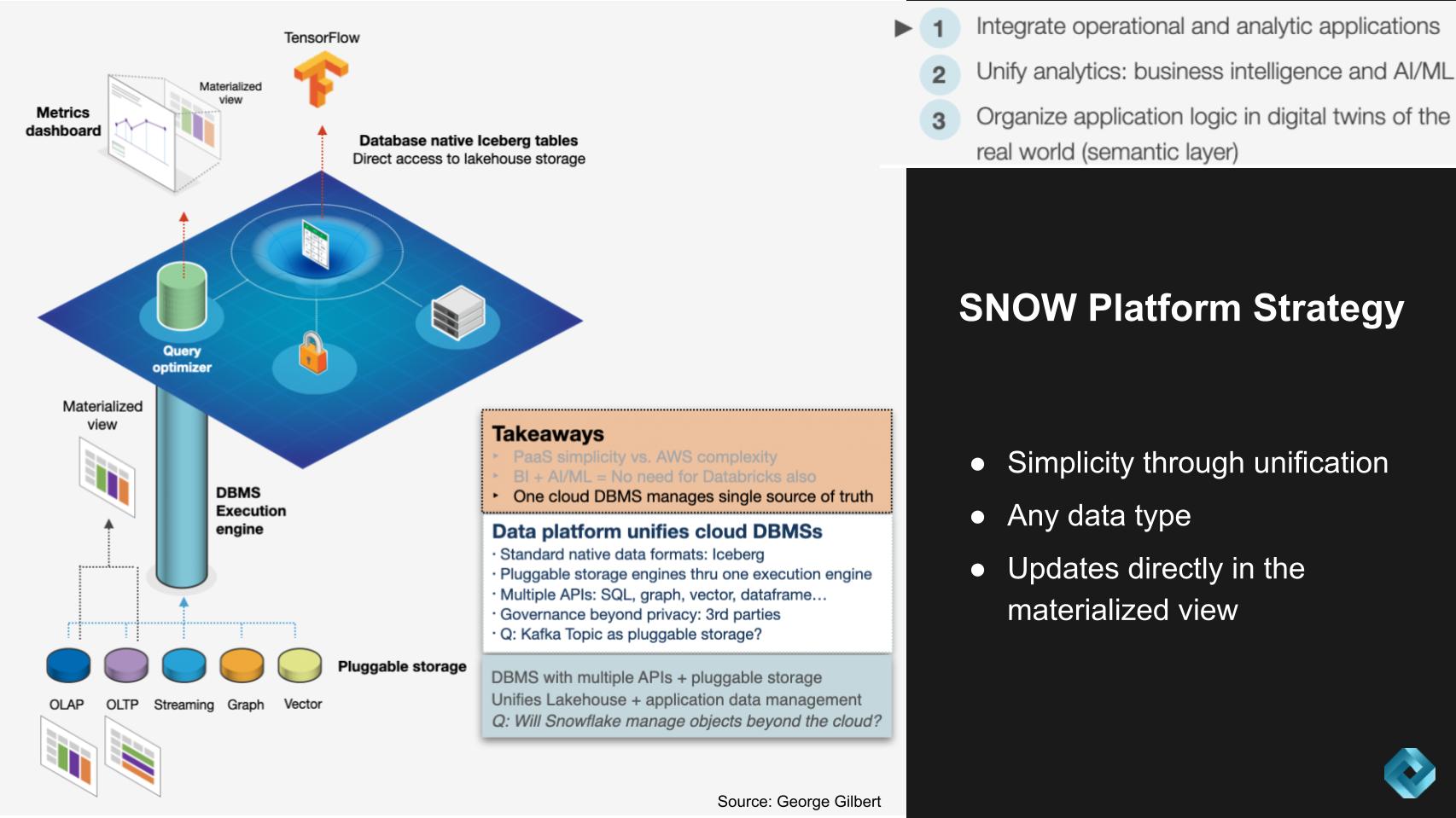

Here are the critical points from the discussion with Gilbert on this topic: Our research points to a vital trend for observers to monitor. The democratization of app development capabilities through platforms such as Snowflake and Databricks. This is fundamental in our view and the shift has the potential to level the playing field, allowing a wider range of organizations to harness the power of sophisticated data applications. Listen and watch George Gilbert explain today’s complexity challenge and the new model application development. Snowflake will continue to support more data typesSnowflake bristles at the idea that it is a data warehouse vendor. Although the firm got its foothold by disrupting traditional enterprise data warehouse markets, it has evolved into a true platform. We think a main thrust of that platform is an experience that promises consistency and governed data sharing on and across clouds. The company’s offering continues to evolve to support any data type through pluggable storage and the ability to extend this promise to materialized views, which implies a wider scope. We believe the next wave of opportunity for Snowflake (and its competitors) is building modern data apps. It’s clear to us that Snowflake wants to be the No. 1 place in the world to build these apps – the iPhone of data apps, if you will. But more specifically, Snowflake in our view wants to be the preferred platform, meaning the fastest time to develop, the most cost-effective, the most secure and most performant place to build and monetize data apps.

The following summarizes our view and the conversation with Gilbert on this topic: One of the core principles of this new modern data stack is supporting all data types and workloads, with Snowflake being a key player in this regard. We believe Snowflake is essentially revolutionizing the data platform, providing a more simplified, yet potent tool for developers to work with. Crucial points from our analysis include: Bottom Line: Our research points to a transformative shift in data management. In the legacy era when everything was on-premises, Oracle managed the operational data while Teradata and others, including Oracle, managed separate analytic data. Snowflake aspires to manage everything from that era and more. Snowflake’s pursuit of unification and simplification offers a considerable boon for developers and organizations alike, paving the way for a future where handling diverse data types and workloads becomes commonplace. This trend is one to watch closely, as it could profoundly shape the data management landscape. Watch this five-minute deep dive into where we see the Snowflake platform architecture heading. Unifying business intelligence with AI and machine learningUnifying BI and AI/ML is a critical theme of the new modern data stack. The slide below shows Snowflake on the left hand side, Databricks on the right, and we see these worlds coming together.

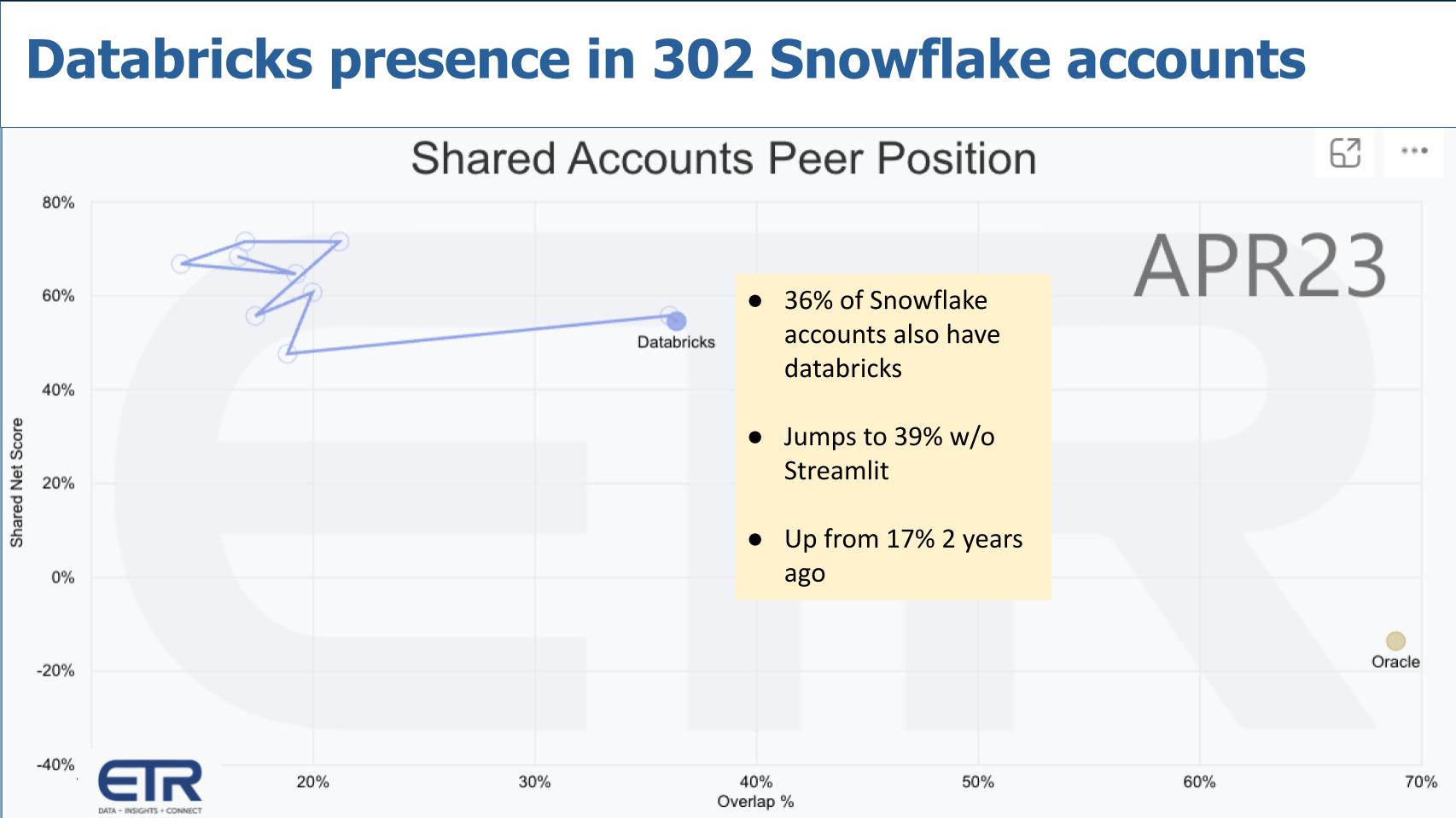

The important points of this graphic and the implications for Databricks, Snowflake and the industry in general can be summarized as follows: The dynamics between Snowflake and Databricks, two key players in the field of business intelligence and AI/ML, are evolving rapidly. Snowflake has made strides in order to try and eliminate the need for Databricks in some contexts, while Databricks is attacking Snowflake’s stronghold in analytics. To date, if a customer wanted the best BI and AI/ML support, they needed both Databricks and Snowflake. Each is trying to be a one-stop-shop. Customers should not have to move data between platforms to perform alternately BI and AI/ML. There has been talk that it would be harder for Snowflake to build Databricks’ technology than vice-versa. The assumption behind that thinking seems to be that BI is old, well-understood technology and AI/ML is newer and less well-understood. But that glosses over the immense difficulty of building a multiworkload, multimodel cloud-scale DBMS. It’s still one of the most challenging products in enterprise software. As Andy Jassy used to say, there’s no compression algorithm for experience. While others are catching up with BI workload support, Snowflake has moved on to transactional workloads and now pluggable data models. On the tools and API side, Snowflake is adding new APIs to support personas that weren’t as well-supported, such as data science and engineering. The dynamics between Snowflake and Databricks, two key players in the field of business intelligence and AI/ML, are evolving rapidly. Snowflake has made strides in order to try and eliminate the need for Databricks in some contexts, while Databricks is attacking Snowflake’s stronghold in analytics. Key points include: Our research indicates that Snowflake is making significant strides towards becoming a one-stop solution that can cater to all data types and workloads. This paradigm shift has the potential to substantially alter the dynamics of the industry, making it a top level trend to follow for analysts and businesses technologists. Basically you’ll be able to take your laptop-based, Python and Pandas data science and data engineering code, and scale it out directly to run on the Snowflake cluster with extremely high compatibility. The numbers we’ve seen are 90% to 95% compatibility. So you might have this situation where it’s more compatible to go from Python on your laptop to Python on Snowflake than Python on Spark. So that’s an example of one case where Snowflake is taking the data science tools that you used to have to go to Databricks for and supporting them natively on Snowflake. Watch this four-minute deep dive into how Snowflake is unifying BI and AI/ML workloads. Databricks’ presence in Snowflake accountsWe’re going to take a break from George’s excellent graphics and come back to the survey data. Let’s answer the following question: To what degree do Snowflake and Databricks customers overlap in the same accounts? This is the power of the ETR platform where we can answer these questions over a time series.

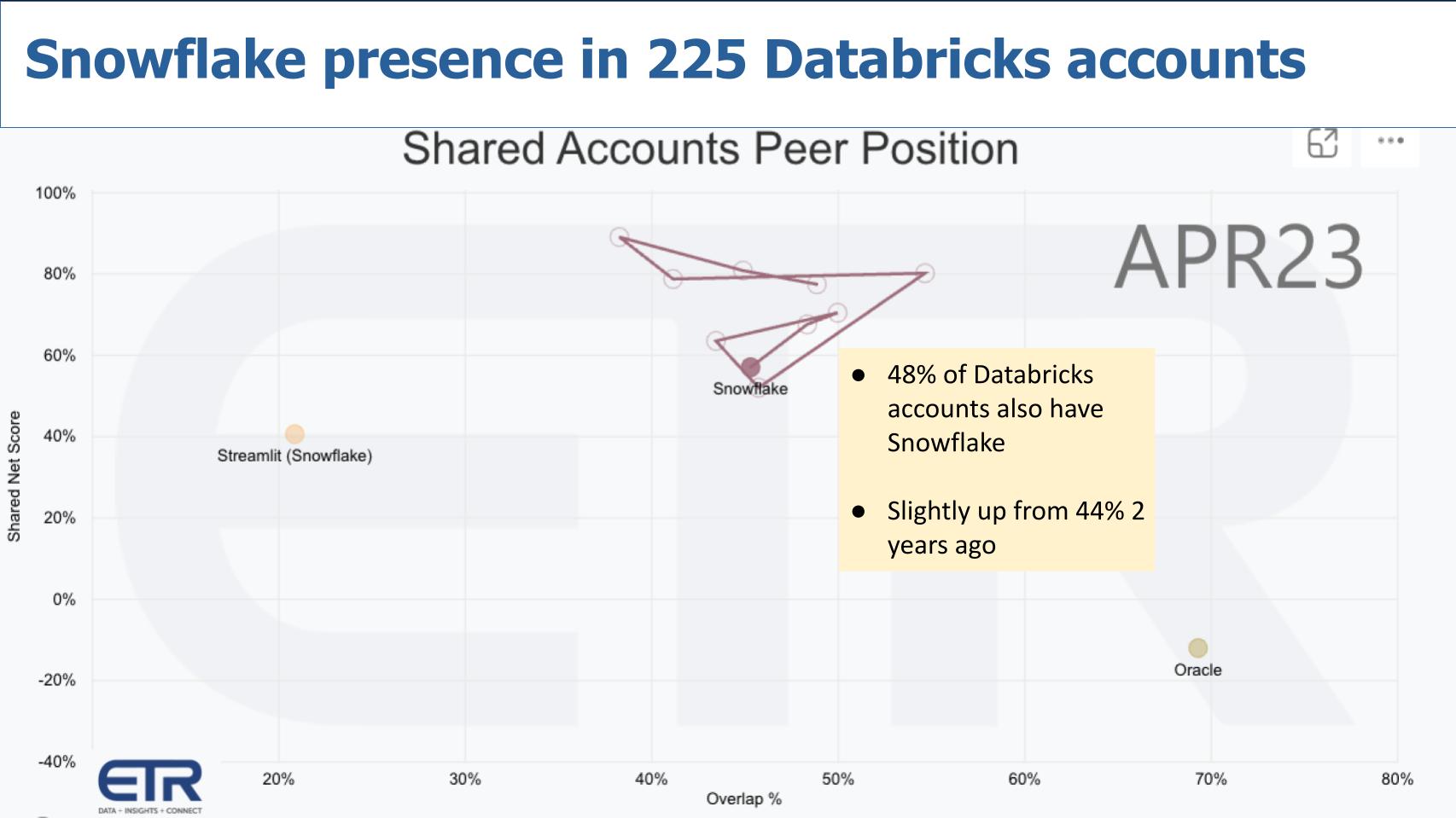

This chart above shows what the presence of Databricks is inside of 302 Snowflake accounts within the ETR survey base. The vertical axis is Net Score or spending momentum and the horizontal axis shows the overlap. We’re plotting Databricks and we added in Oracle for context. Thirty-six percent of those Snowflake accounts are also running Databricks. That jumps to 39% if you take Streamlit out of the numbers. And notably this figure is up from 17% two years ago and 14% two years ago without Streamlit. The point is Databricks’ presence inside of Snowflake accounts has risen dramatically in the past 24 months. And that’s a warning shot to Snowflake. As an aside, Oracle is present in 69% of Snowflake accounts. Snowflake’s presence in Databricks accountsNow let’s flip the picture — in other words, how penetrated is Snowflake inside Databricks accounts, which is what we show below. As you can see, that number is 48%, but that’s only up slightly from 44% two years ago. So Databricks, despite the growth of Snowflake over the past two years, is more prominent in terms of penetrating Snowflake accounts.

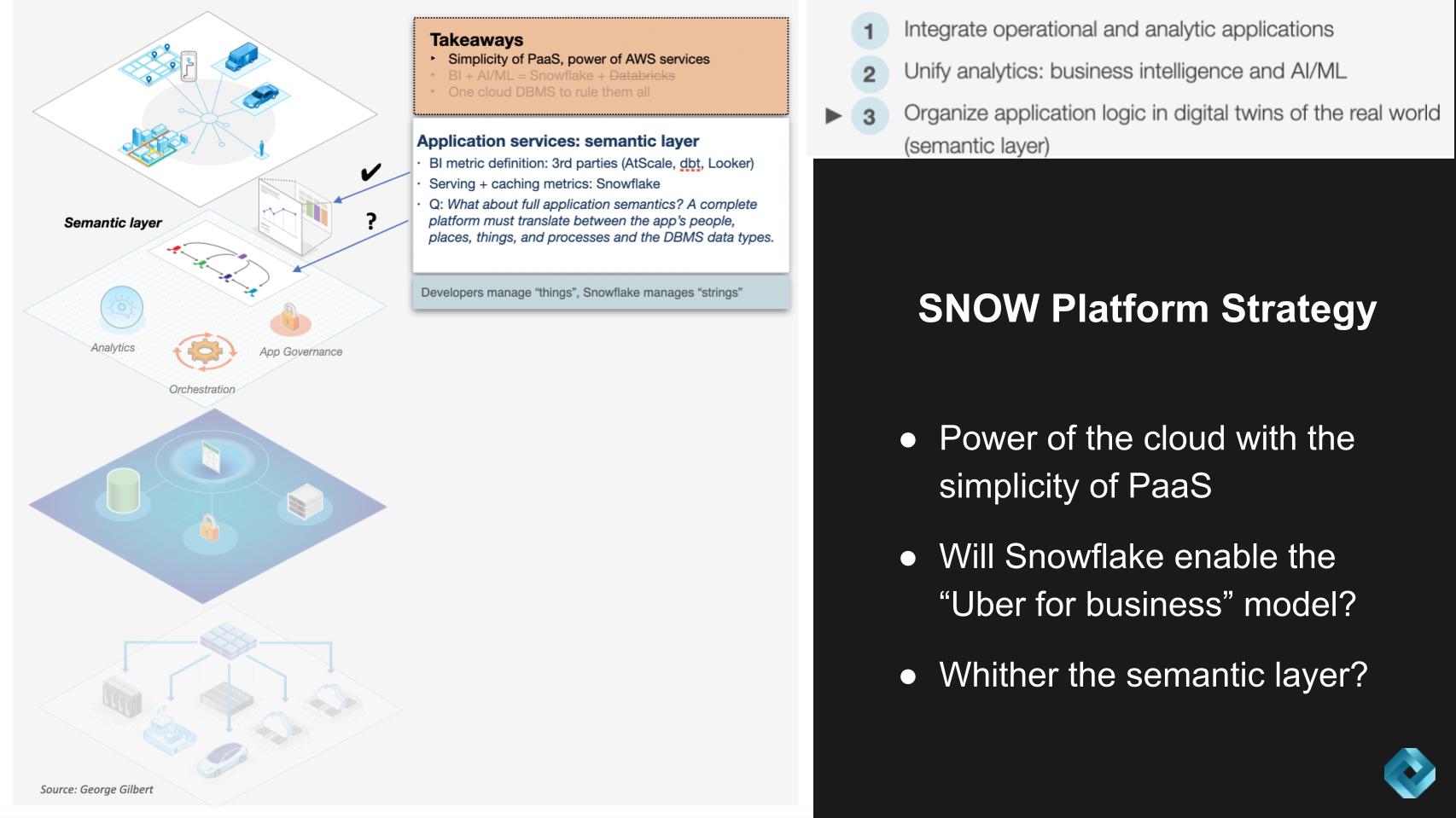

Here’s our summary of the overlap between these two platforms: We believe the maturity of organizations in terms of their data platform utilization is evolving rapidly. The increasing overlap between Snowflake and Databricks can be seen as a response to these companies’ realization that to extract maximum value from their data, they need to address both business intelligence and AI/ML workloads. Key takeaways from this analysis include: Our research indicates a dynamic environment where data platforms are progressively diversifying their capabilities. With Snowflake making notable progress in addressing data science and engineering workloads, organizations may need to reassess their data strategy to maximize value from these evolving platforms. Databricks is not standing still and its growth rates, based on our information, continue to exceed those of Snowflake, albeit from a smaller revenue base. The critical semantic layerLet’s now jump to the third key pillar, which brings us deeper into the semantic layer. The graphic below emphasizes the notion of organizing application logic into digital twins of a business. Our assertion is this fundamentally requires a semantic layer. This is one area where are research is inconclusive with regard to Snowflake’s plans. Initially we felt that Snowflake could take an ecosystem approach and allow third parties to manage the semantic layer. However, we see this as a potential blind spot to Snowflake and could pose the risk of losing control of the full data stack. A summary of our analysis follows:

The semantic layer is starting to emerge as BI metrics. These metrics, like bookings, billings and revenue, or more specific examples like Uber’s rides per hour, were traditionally managed by BI tools. These tools had to extract data from the database to define and update these metrics, which was a challenging and resource-intensive process. The First Step: Business Intelligence MetricsSemantic layer implementation: Snowflake in our view intends to take on the critically demanding task of supporting these metrics. It will cache the live, aggregated data that will allow BI tool users to slice and dice by dimension. We believe it plans to support third parties, such as AtScale Inc., dbt Labs Inc. and Google-owned Looker, to define the metrics and dimensions. Previously, such tools typically had to cache data extracts outside the DBMSs themselves. This approach fits with Snowflake’s business model of supporting an ecosystem of tools. In essence, we believe that that if Snowflake’s approach to handling the semantic layer within its platform is to leave that to third parties, it might be too narrow and potentially misses the broader implications and challenges of application semantics. Watch this three-minute clip describing the importance of the semantic layer and the risks to Snowflake of not owning it. Roadmap: Why Snowflake might vertically integrate the semantic layerLet’s double-click on this notion of the semantic layer and its importance. Further, we want to explore what it means for Snowflake in terms of who owns the semantic layer and how to translate the language of people, places and things into the language of databases.

In essence, we believe that if Snowflake’s approach to handling the semantic layer within its platform is to leave it to third parties, they may lose control of the application platform and their destiny. Snowflake aspires to build a platform for applications that handles all data and workloads. In the 1990s, Oracle wanted developers to code application logic in their tools and in the DBMS stored procedures. But Oracle lost control of the application stack as SAP, PeopleSoft and then the Java community around BEA all built a new layer for application logic. That’s the risk if Snowflake doesn’t get this layer right. Watch this two-minute riff on why Snowflake may want to vertically integrate the semantic layer. The leading data platforms all want a piece of the actionLet’s examine the horses on the track in this race. The Belmont stakes is this weekend. It’s a grueling, mile-and-a-half race… it’s not a sprint. Below we take a look at the marathon runners in the world of cloud data platforms.

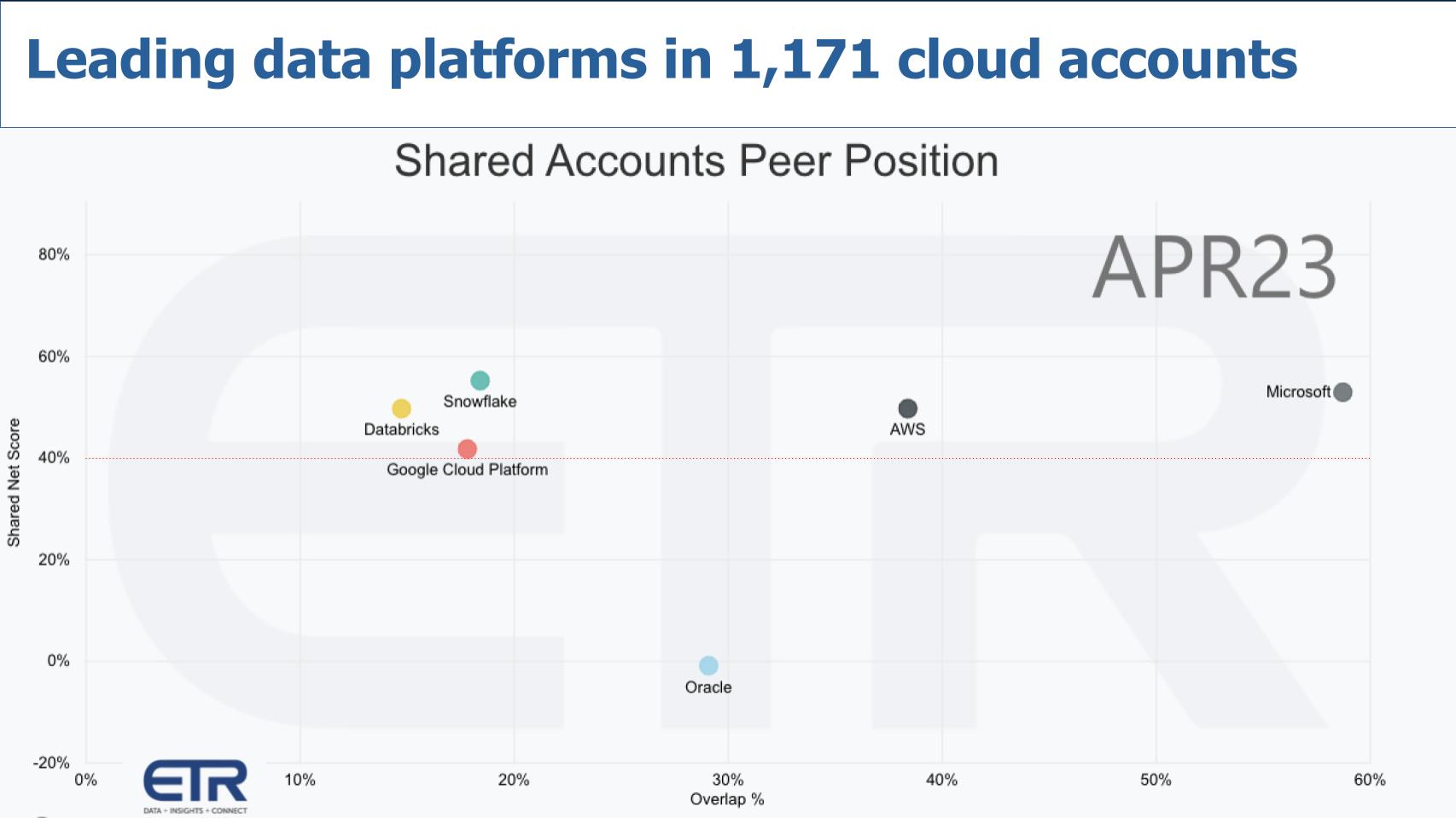

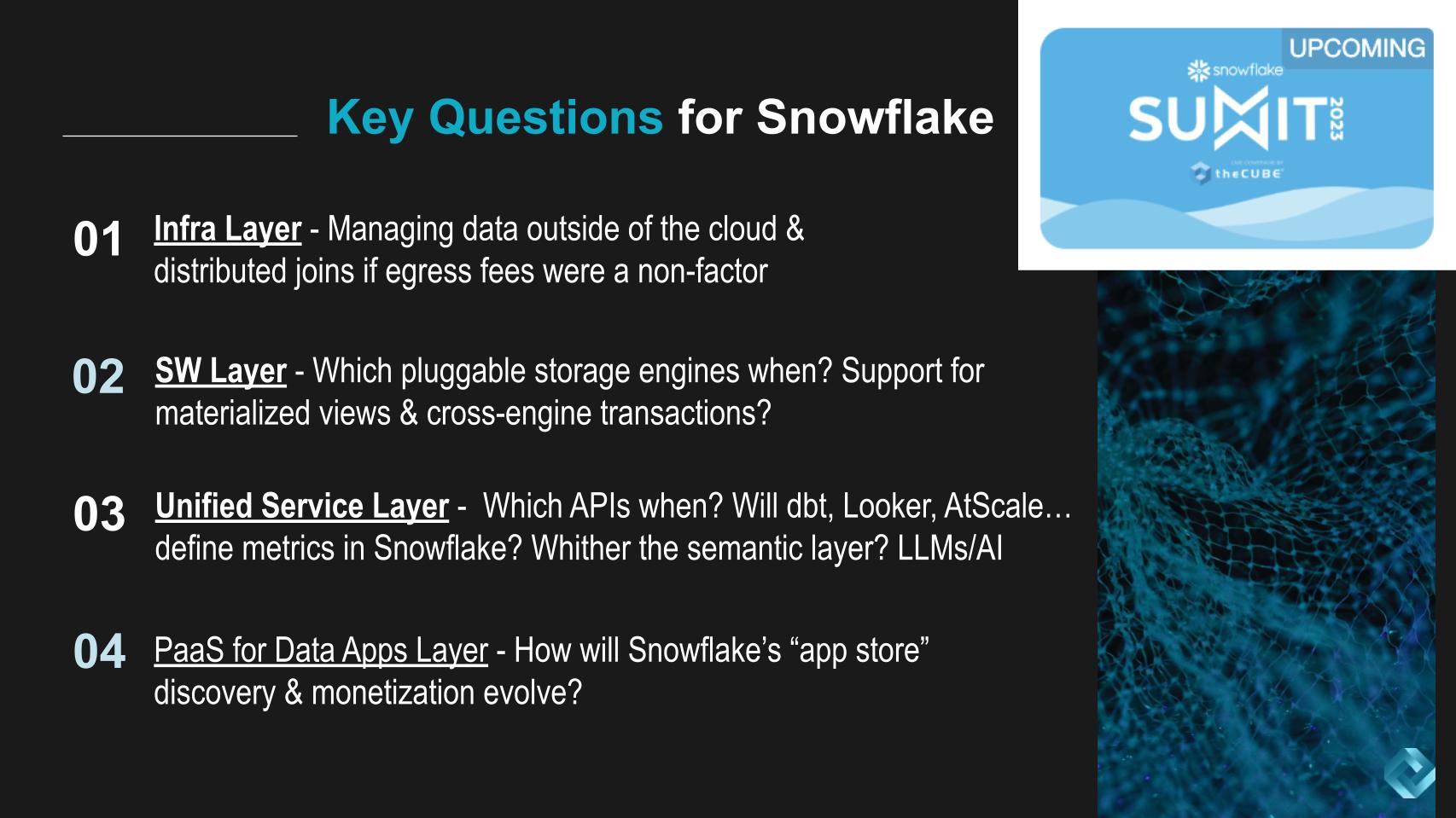

The graphic above uses the same dimensions as earlier, Net Score or spending momentum on the Y axis and the N overlap within a filter of 1,171 cloud accounts in the ETR data set. That red line at 40% indicates a highly elevated Net Score. Microsoft just announced Fabric. By virtue of its size and simple business model (for customers), it is furthest up to the right in spending metrics and market presence. Not necessarily function but the model works. AWS is “gluing” together its various data platforms that are successful. Google has a killer product in Big Query, with perhaps the best AI chops in the business, but is behind in both momentum and market presence. Databricks and Snowflake both have strong spending momentum notwithstanding that Snowflake’s Net Score has been in decline since the January 2022 survey peak. Howeve, both Snowflake’s and Databricks’ Net Scores are highly elevated. Here’s our overall analysis of the industry direction: The big change is we believe the market will increasingly demand unification and simplification. It starts with unifying the data, so that your analytic data is in one place. So first, there’s one source of truth for analytic data. Then we’ll add to that one source of truth all your operational data. Then build one uniform engine for accessing all that data and then that unified application stack that maps people, places, things and activities to that one source of truth. Here’s our exam of the leading players: The overall theme of our analysis suggests that these major providers are working towards consolidating and streamlining their data architectures to facilitate a single source of truth, including both analytic and operational data, making it easier to build and manage data apps. However, each of these platforms has its unique set of challenges in achieving this goal. Listen and watch this four-minute discussion where George Gilbert goes through the maturity model for each vendor with respect to unifying data. Key questions to watch at Snowflake Summit 2023Let’s close with the key issues we’ll be exploring at Snowflake Summit and Databricks events, which take place the same week in late June. We’re going to start at the bottom layer of the stack in the chart below and work our way up the stack down on this slide.

Before we get into the stack, one related area we’re exploring is Snowflake’s strategy of managing data outside the cloud. It’s unclear how Snowflake plans to accommodate this data. We’ve seen some examples of partnerships with Dell Technologies Inc., but at physical distances there are questions about its capacity to handle tasks like distributed joins. We wonder how it would respond if data egress fees were not a factor. Moving to the stack: We expect to get more clues and possibly direct data from Snowflake (and Databricks) later this month. As well, we continue to research the evolution of cloud computing. We’re reminded of the Unix days, where the burden of assembling services fell on the developer. We see Snowflake’s approach as an effort to simplify this approach by offering a more integrated and coherent development stack. Lastly, Snowflake plays in a highly competitive landscape where companies such as Amazon, Databricks, Google and Microsoft constantly add new features to their platforms. Nonetheless, we believe Snowflake continues be ahead and has positioned itself as a company that can utilize the robust infrastructure of the cloud (primarily AWS) but simultaneously simplify the development of data apps. On balance, this will require a developer tools mindset and force Snowflake to move beyond its database comfort zone — a nontrivial agenda that could reap massive rewards for the company and its customers. Keep in touchMany thanks to George Gilbert for his collaboration on this research. Thanks to Alex Myerson and Ken Shifman on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight, who help us keep our community informed and get the word out, and to Rob Hof, our editor in chief at SiliconANGLE. Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen. Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts. Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai. Here’s the full video analysis: All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions. Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of Wikibon. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis. Image: Dennis/Adobe Stock Your vote of support is important to us and it helps us keep the content FREE. One-click below supports our mission to provide free, deep and relevant content. Join our community on YouTube Join the community that includes more than 15,000 #CubeAlumni experts, including Amazon.com CEO Andy Jassy, Dell Technologies founder and CEO Michael Dell, Intel CEO Pat Gelsinger and many more luminaries and experts.“TheCUBE is an important partner to the industry. You guys really are a part of our events and we really appreciate you coming and I know people appreciate the content you create as well” – Andy Jassy THANK YOU Securities Industry Essentials (SIE) ExamThe qualification tests for several occupations in the financial services industry, formerly known as the Series exams, have been streamlined into one initial exam called the Securities Industry Essentials Exam—or the SIE Exam. Passing this exam qualifies you to pursue a career in the financial services industry. Back in 2015, Financial Industry Regulatory Authority (FINRA) streamlined its testing structure by consolidating the fundamental knowledge shared across several of the Series exams into the SIE. Candidates can then take an additional "top-off" qualification exam for the specific field they hope to enter. Key TakeawaysThe SIE had a major structural impact on the qualification exams. The SIE replaces portions of every previous exam, including the Series 6, Series 7, Series 22, Series 55/56 (replaced by Series 57), Series 79, Series 82, Series 86/87, and Series 99. These tests were shrunken, becoming qualification exams that focus on the specialized knowledge needed for each particular qualification. Top-off exams are offered for the following representative categories: Overall, this was clearly an effort to remove some of the duplicated information in the tests, but it also opened the door to a much more important change to the process of qualification, which is no longer having to be associated with a FINRA member firm to take the SIE. Under the former FINRA rules, you generally needed to be employed or otherwise sponsored by a FINRA member in order to take the exams. The SIE removes this requirement, although you still have to be associated with a FINRA member firm to take the top-off exams. This means that an individual can choose to start on the path towards a FINRA qualification on their own. Successfully taking the SIE doesn't guarantee anyone a successfully break into the financial industry, but it is safe to say that passing it prior to looking for a job may give you an edge as a prospective employer only needs to sponsor the top-off exam to get you qualified for a particular role. FINRA supported the idea that recent graduates and people looking to get into the industry should take the SIE on their own. They’ve made it more attractive by extending the validity of the SIE to four years, giving a generous window for passing participants to then find a firm to sponsor the top-off exams. FINRA member firms are able to see who has passed the exam via the Central Registration Depository (CRD). SIE and Top Off-Exams as ReplacementsIn their original Securities and Exchange Commission filings, FINRA targeted the fall of 2016 to early 2017 for a rollout of their highest volume exams. This proved to be a bit optimistic. There were several shifts in the scheduling, one resulting from the requests of member firms and industry associations for more time to set their own processes in accordance with the new structure. The SIE and top-off exam rollout took place on Oct. 1, 2018 and was accompanied by the retirement of multiple low-volume exams, such as the Series 42 and Series 62. Originally, March 2018 was targeted for the implementation of the SIE and top-offs for Series 6, 7, and 79. Oct. 1, 2018 became the date for a complete overhaul rather than a phased-in approach. Adding to some of the confusion was part of the attempt to modernize; the Series 55 was replaced by the Series 57, although it still appeared in the original notice for the SIE updates. That update was simply a standard part of FINRA reviewing and tweaking curriculum, rather than part of an overhaul of any core knowledge. Structure of the SIE ExamThe SIE exam structure is largely based on the general knowledge components of the exams it replaced that portion for. In January 2018, FINRA provided more details on the structure. The sections and question count are as follows: The Makeup of the SIE Exam Section Percentageof Exam Questions Number ofExam Questions (1) Knowledge of Capital Market 16% 12 (2) Understanding Products and Their Risks 44% 33 (3) Understanding Trading, Customer Accounts, and Prohibited Activities 31% 23 (4) Overview of Regulatory Framework 9% 7 Total 100% 75The 75 questions are actually 85, since there are 10 randomly distributed pre-test questions that do not count towards the score on the exam. Candidates have an hour and forty-five minutes to complete the entire exam. A full outline of the SIE content is currently available on FINRA's website. Benefits of the SIE ExamPassing the SIE exam can provide a number of benefits to your career: If you already passed one of the FINRA exams and are currently registered as a representative, you are considered to have passed the SIE already. If you passed one of the exams and are not currently registered, you may need to take the SIE depending on how many years elapse between now and your next registration. And, of course, if you passed the exam but your registration has lapsed, you will need to take the SIE and the new top-off for that qualification before being reregistered. This is pretty much the same as it has always been, except you would be taking two exams instead of one. In fact, the exams are designed to take the same total time as the previous versions. For example, the SIE and Series 7 top-off exam take the same amount of time as the previous Series 7 exam. For member firms, the cost of the top-off exams is less than the previous exams because the content was shifted to the SIE. So, if an individual has passed the SIE prior to joining a firm, it is a good indication that this person already has the basic aptitude and wherewithal to pass a top-off exam. The cost of getting that individual registered is reduced because they paid out-of-pocket for the SIE, which will likely help make a candidate more attractive to a firm. What Is the SIE Exam for?The Securities Industry Essentials (SIE) Exam is designed to assess your knowledge of the securities industry. It ensures that people entering the industry are qualified and knowledgeable for the work they are doing. It streamlines the previous initial qualification exams into a single test, supplemented by "top-off" qualification exams. What Does Passing the SIE Do for You?If you want to be registered to work in a securities business, you must pass the SIE and the appropriate qualification exam for the type of securities work you'll be doing. If you already took one of the old exams and your license lapsed—assuming two years have passed since you were last registered—you have to retake the Series 7. You need to retake the SIE only if four years have elapsed since you last passed it or were last registered. Is the SIE Harder Than the Series 7?The overall content covered over the two tests—the SIE and the Series 7 top-off exam—will be nearly identical to the previous Series 7. How Often Do People Fail the SIE?FINRA does not share the SIE pass rates. However, various test prep companies state that around 25-27% of candidates fail the exam on the first try. If you fail and want to retake the exam, the wait time is 30 days for the first and second attempts, then six months if you fail the third attempt. The Bottom LineIf you were already sponsored to take one of the qualification exams, go for it. These changes won't impact you at all. If you expect to be sponsored in the future, the overall content you need to master won’t change even though you have to do it in two chunks. If, however, you are not currently sponsored or in the industry, the SIE will open the door for you to start down the path of a financial career without having to associate with a member firm first. This change gives you a choice you didn't have before. |

While it is hard job to pick solid certification questions/answers regarding review, reputation and validity since individuals get sham because of picking incorrec service. Killexams.com ensure to serve its customers best to its efforts as for exam dumps update and validity. Most of other's post false reports with objections about us for the brain dumps bout our customers pass their exams cheerfully and effortlessly. We never bargain on our review, reputation and quality because killexams review, killexams reputation and killexams customer certainty is imperative to us. Extraordinarily we deal with false killexams.com review, killexams.com reputation, killexams.com scam reports. killexams.com trust, killexams.com validity, killexams.com report and killexams.com that are posted by genuine customers is helpful to others. If you see any false report posted by our opponents with the name killexams scam report on web, killexams.com score reports, killexams.com reviews, killexams.com protestation or something like this, simply remember there are constantly terrible individuals harming reputation of good administrations because of their advantages. Most clients that pass their exams utilizing killexams.com brain dumps, killexams PDF questions, killexams practice questions, killexams exam VCE simulator. Visit our example questions and test brain dumps, our exam simulator and you will realize that killexams.com is the best exam dumps site.

Which is the best dumps website?

Sure, Killexams is 100 % legit in addition to fully well-performing. There are several includes that makes killexams.com genuine and reliable. It provides recent and 100 % valid exam dumps containing real exams questions and answers. Price is really low as compared to almost all of the services online. The questions and answers are modified on frequent basis with most recent brain dumps. Killexams account method and solution delivery is really fast. Computer file downloading is definitely unlimited and extremely fast. Assistance is avaiable via Livechat and Electronic mail. These are the features that makes killexams.com a strong website that supply exam dumps with real exams questions.

Is killexams.com test material dependable?

There are several Questions and Answers provider in the market claiming that they provide Actual Exam Questions, Braindumps, Practice Tests, Study Guides, cheat sheet and many other names, but most of them are re-sellers that do not update their contents frequently. Killexams.com is best website of Year 2023 that understands the issue candidates face when they spend their time studying obsolete contents taken from free pdf download sites or reseller sites. Thats why killexams.com update Exam Questions and Answers with the same frequency as they are updated in Real Test. Exam dumps provided by killexams.com are Reliable, Up-to-date and validated by Certified Professionals. They maintain Question Bank of valid Questions that is kept up-to-date by checking update on daily basis.

If you want to Pass your Exam Fast with improvement in your knowledge about latest course contents and topics of new syllabus, We recommend to Download PDF Exam Questions from killexams.com and get ready for actual exam. When you feel that you should register for Premium Version, Just choose visit killexams.com and register, you will receive your Username/Password in your Email within 5 to 10 minutes. All the future updates and changes in Questions and Answers will be provided in your Download Account. You can download Premium Exam Dumps files as many times as you want, There is no limit.

Killexams.com has provided VCE Practice Test Software to Practice your Exam by Taking Test Frequently. It asks the Real Exam Questions and Marks Your Progress. You can take test as many times as you want. There is no limit. It will make your test prep very fast and effective. When you start getting 100% Marks with complete Pool of Questions, you will be ready to take Actual Test. Go register for Test in Test Center and Enjoy your Success.

AI-900 braindumps | BCNS-CNS test prep | PCAP-31-03 test prep | PEGACPMC84V1 exam dumps | CQIA exam questions | INBDE PDF Download | PSPO-I questions answers | AZ-140 dumps questions | S90.03A Dumps | IIA-CIA-Part1 PDF Braindumps | Servicenow-CIS-RC Questions and Answers | 9L0-066 real questions | H12-211 Exam Questions | PEGAPCSSA85V1 dumps | PTCE Practice Questions | FSMC Practice Test | 4A0-M01 practice questions | AD0-E116 cheat sheets | Apigee-API-Engineer brain dumps | PC-BA-FBA-20 test prep |

ARA-C01 - SnowPro Advanced Architect Certification exam contents

ARA-C01 - SnowPro Advanced Architect Certification learn

ARA-C01 - SnowPro Advanced Architect Certification PDF Dumps

ARA-C01 - SnowPro Advanced Architect Certification course outline

ARA-C01 - SnowPro Advanced Architect Certification exam format

ARA-C01 - SnowPro Advanced Architect Certification Exam Questions

ARA-C01 - SnowPro Advanced Architect Certification Question Bank

ARA-C01 - SnowPro Advanced Architect Certification Dumps

ARA-C01 - SnowPro Advanced Architect Certification learn

ARA-C01 - SnowPro Advanced Architect Certification information hunger

ARA-C01 - SnowPro Advanced Architect Certification Actual Questions

ARA-C01 - SnowPro Advanced Architect Certification test

ARA-C01 - SnowPro Advanced Architect Certification techniques

ARA-C01 - SnowPro Advanced Architect Certification study help

ARA-C01 - SnowPro Advanced Architect Certification PDF Dumps

ARA-C01 - SnowPro Advanced Architect Certification Latest Topics

ARA-C01 - SnowPro Advanced Architect Certification guide

ARA-C01 - SnowPro Advanced Architect Certification learn

ARA-C01 - SnowPro Advanced Architect Certification information source

ARA-C01 - SnowPro Advanced Architect Certification test

ARA-C01 - SnowPro Advanced Architect Certification guide

ARA-C01 - SnowPro Advanced Architect Certification certification

ARA-C01 - SnowPro Advanced Architect Certification Exam dumps

ARA-C01 - SnowPro Advanced Architect Certification Questions and Answers

ARA-C01 - SnowPro Advanced Architect Certification guide

ARA-C01 - SnowPro Advanced Architect Certification PDF Download

ARA-C01 - SnowPro Advanced Architect Certification outline

ARA-C01 - SnowPro Advanced Architect Certification PDF Questions

ARA-C01 - SnowPro Advanced Architect Certification boot camp

ARA-C01 - SnowPro Advanced Architect Certification Practice Questions

ARA-C01 - SnowPro Advanced Architect Certification tricks

ARA-C01 - SnowPro Advanced Architect Certification Test Prep

ARA-C01 - SnowPro Advanced Architect Certification book

ARA-C01 - SnowPro Advanced Architect Certification Test Prep

ARA-C01 - SnowPro Advanced Architect Certification information search

ARA-C01 - SnowPro Advanced Architect Certification Dumps

ARA-C01 - SnowPro Advanced Architect Certification Latest Questions

ARA-C01 - SnowPro Advanced Architect Certification testing

Other SnowFlake Exam Dumps

COF-C01 practice exam | COF-R02 Exam Questions | DEA-C01 practice exam | COF-C02 boot camp | ARA-C01 Study Guide |

Best Exam Dumps You Ever Experienced

1Y0-241 test practice | AD0-E308 Free Exam PDF | MS-101 real questions | 300-815 practice exam | CTFL PDF Questions | 200-045 dumps | AZ-140 free online test | LCDC cheat sheets | CTP PDF Download | CWAP-403 online exam | Series66 questions answers | Magento-2-Certified-Associate-Developer download | NCLEX-RN mock questions | 2B0-011 practice test | 630-008 past bar exams | HD0-400 exam dumps | QAWI201V3-0 Actual Questions | NSE6 braindumps | DP-203 VCE | 3X0-203 practice exam |

References :

Similar Websites :

Pass4sure Certification Exam dumps

Pass4Sure Exam Questions and Dumps